The evolution of the management of its project portfolios brings to a North American financial institution a better control of its investment budget (more than one billion euros*).

A leading financial institution has significantly increased its investment budget over several years, raising the stakes for the governance and management of its project portfolios. By rethinking the mechanisms and rules of appraisal, prioritization, and financial commitment of its projects, inspired by best practices, the company regained the desired level of control of its investment budget with the support of PMP.

Context

Present in a very wide range of financial products and services, the company divides the management of its investment projects into several portfolios, specialized in certain businesses or cross-functional activities.

The company saw its annual investment budget grow by 30% per year for 4 years, resulting in several important difficulties:

- Less frequent application of prioritization and reallocation mechanisms for budgets and resources.

- Less systematic compliance with governance rules, associated with poorer quality data feedback.

- Strain on monitoring bodies to manage the volume and diversity of projects.

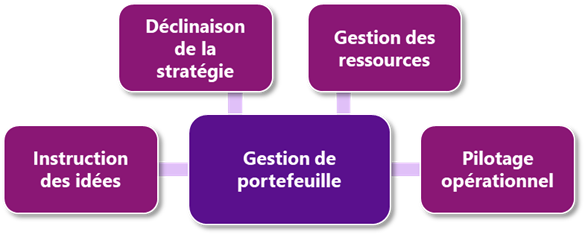

Project portfolio management is a key to corporate governance. It allows the company to take into account its strategy and available resources (in particular the investment budget) when deciding which projects to implement, using which resources, and for which benefits. By clarifying and optimizing the rules for appraising ideas, prioritizing projects according to strategic axes, and validating financial commitments, the company ensures that it maximizes its performance by putting the effort in the right place at the right time, through appropriate governance.

PMP framework for value-based management, applied to portfolio management

Our approach

With our combined expertise in the banking sector and organizational performance, and familiarity with the culture of this company, PMP worked with the strategy team, the teams in charge of corporate governance, and those managing the bulk of its project portfolios. The mission covered 4 areas:

- Clarification of the roles and responsibilities involved in decision making;

- Redesign of processes, from idea appraisal to financial commitment validation;

- Definition of the methods and tools required to conduct a performance dialogue upstream of budget allocation;

- Assessment of the transformation needs to be considered by the company in the medium and long term to continuously improve its organizational performance.

The results

- Realignment of governance roles and responsibilities;

- Reduction of up to 50% of the volume of projects to be reviewed in each decision-making body;

- Convergence to a single idea appraisal model for the core portfolio;

- Definition of a model for prioritizing projects in line with the strategic axes, with deployment in several areas of the company;

- Recommendation of 10 major transformation projects to be implemented in the short, medium and long term to move the organization forward.

Mathieu Dorian, (Manager), Nicolas Moreau (Consultant) and Eric Panet-Raymond (Associate)

* Currency converted to Euro to respect the anonymity of the company