With one million users in the United Kingdom, the advent of DPS2 for the European Union and many jurisdictions around the world, having started to deploy their regulatory frameworks to force their implementation, the demonstration is no longer to do that Open Banking already has, and will have a growing impact on the banking industry.

Therefore, the question arises for the insurance industry: Is such a scenario possible in insurance? What lessons can traditional insurers learn from Open Banking? How do traditional players take advantage of this new situation? What strategies? What implementation considerations?

October 2020 – 8 mn

The number of consumers using Open Banking in the UK has doubled in six months, reaching one million in January 2020. Exactly two years after the UK’s nine big banks were forced by regulators to set up a first wave of Open Banking services. Since then, more than 200 financial service providers have started offering value-added services to clients of these banks and generate 200 million calls to their information systems each month.

This dual adoption, supply side and demand side, transforms the industry value chain in many areas: Account-to-account payment, Personal Finance Management tools, debt consolidation, simplified granting of financing for individuals and SMEs, access to financing for the underbanked, alternative financing, and even mortgage loans are the subject of many innovations.This creates a dynamic of “coopetition” between banks and FinTechs, generating both reductions in profitability and new sources of income for traditional banks on their own offer as well as new services.

This transformation is rapidly spreading to other markets. Australia made Open Banking mandatory for its 4 largest banks in January 2020. The EU launched its own regulations in 2019, with a focus on payments and a scope covering all banking institutions. In Singapore, the dynamics of the industry mean that banks like DBS already offer more than 200 APIs without the regulator having made Open Banking mandatory, but it is catalyzing innovation, for example with APIX, a marketplace financial APIs. In Canada, regulators are letting the industry move forward on a “reasonable” proposal for norms and standards. Finally, even in the absence of specific regulations, Open Banking is beginning to develop in other markets,forcing governments and traditional banks to adapt.

Therefore, the question arises for the insurance industry: Is such a scenario possible in insurance, and what lessons can traditional insurers draw from Open Banking?

- Open Banking has been mainly forced by regulators, yet regulators are starting to look at its applicability to other sectors of finance, including insurance

Regulators see Open Insurance as a way to boost the financial ecosystem to better meet consumer expectations. Consumers increasingly aware of the value of their data and who are willing to share it in return for a profit.

On the other hand, they see it as a way of promoting innovation to fight against the systemic risks generated by underinsurance, the impacts of climate change on home risks and the evolution of the insurable material. In addition to innovation, there is increased transparency of prices and services, a way for regulators to increase the competitiveness of financial centers, and therefore attractiveness for businesses.

In the United Kingdom, the Financial Conduct Authority has therefore launched a call for contributions for autumn 2020 on the theme of Open Finance, explicitly covering damage, life and health insurance.

- Like Open Banking, Open Insurance is not a business model in itself. Depending on your competitive position, you should consider a “platform” strategy or an “Insurance-as-a-Service” strategy

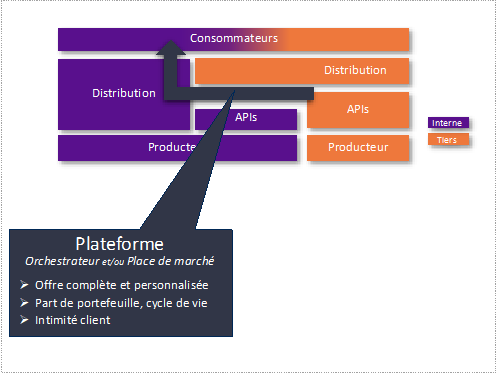

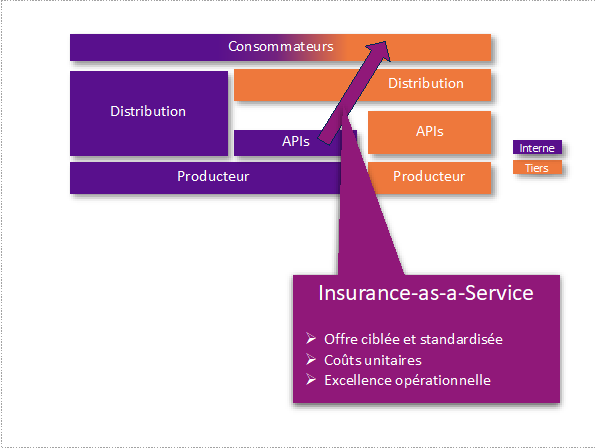

Simply responding to the regulator’s requirements by passively opening up access to customer data creates a risk of long-term relevance. In open models, value creation is based on the organization’s ability to connect bi-directionally to the different actors and data sources throughout the value chain, particularly outside traditional insurance territories, thus opening the way to new business models and product innovation. The experience of banks shows that two families of winning “Open” strategies are emerging for traditional insurers: the “Platform” strategy and the “Insurance as a Service” strategy.

- “Platform” strategy: capitalize on a dominant market position and a privileged relationship with a large customer base to aggregate the data of these customers and offer them a wide range of personalized products and services. It can produce them itself or have them produced by external producers who are:

at. Either partners pre-selected individually for each offer (Orchestrator model)

b. Or themselves put in competition on the bank’s platform and it is the customer who chooses the offer that suits him best (Marketplace model)

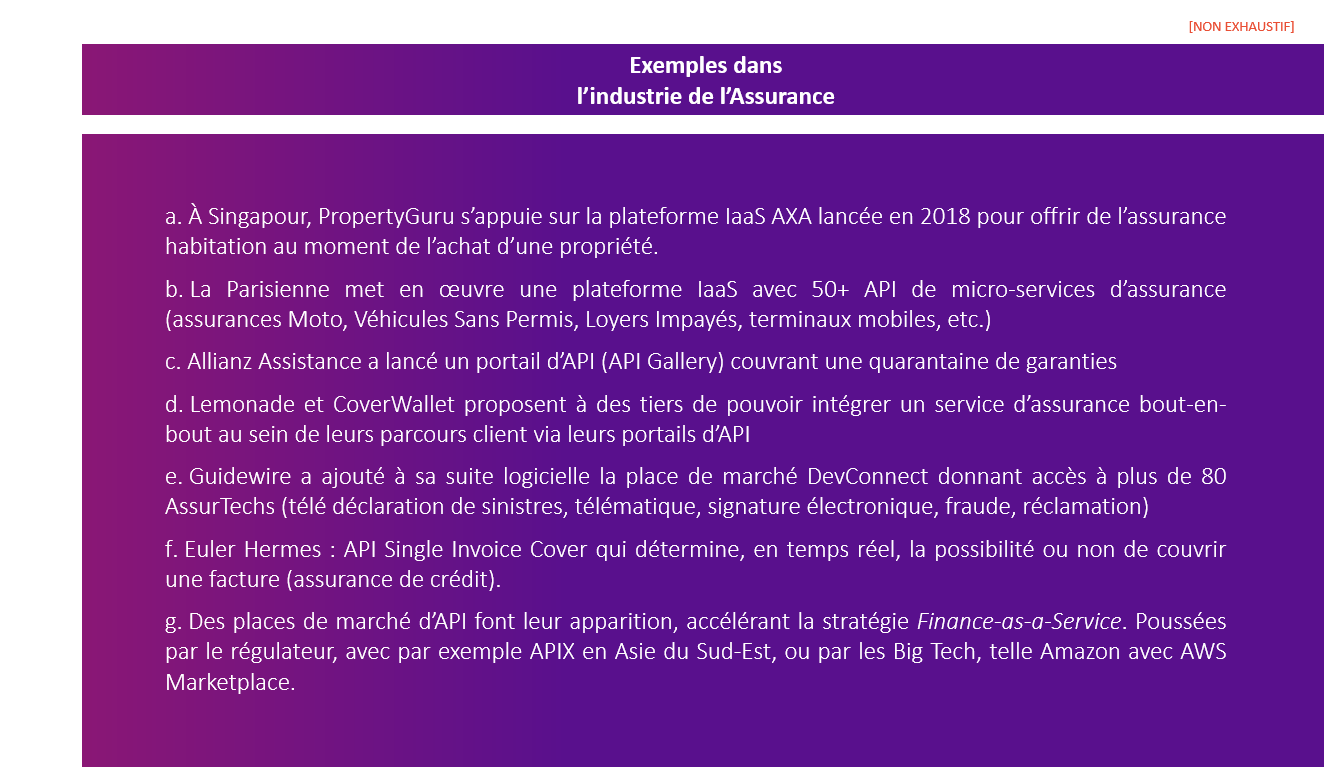

2. Insurance as a Service (IaaS) strategy: capitalize on the know-how of internal and external producers, in particular in risk management, and competitive unit costs to offer insurance products and services through an ecosystem of partners:

a. In the financial sector in white label mode in a logic of leadership on unit costs and excellence of the offer, reaching through partners of customers that the insurer’s distribution could not directly seek (geographies, segments, etc.)

b. In non-financial sectors, which distribute the offer in a multitude of niche experiences aimed at reaching new customers upstream of their insurance need, at the time of acquisition for example, not necessarily in white label.

In these two strategies, the question of the ownership of the relationship with the consumer is crucial, both for future growth opportunities, and for insurance-specific activities such as risk management and prevention. From these choices, several income models arise:

- B2B2C: Consumers pay the producer who pays a commission to the distributor.

- B2B: Consumers pay the distributor who buys the services from the producer.

- Indirect: For the producer, as for the distributor, the creation of value can also come from the capacity to exploit commercially the increase in the participation of consumers in its ecosystem, from the ownership of the relationship with the consumer, or from the valuation of its data.

Industry sets in motion, in an area where supply typically conditions demand.

Banks like BBVA, DBS, JP Morgan, Green Dot and FinTechs like Starling have adopted first-mover strategies that successfully capitalize on Open Banking, without waiting for regulators to force the market.

A few years later, history repeats itself in the insurance field with increasingly active participants: AssurTech and neo-insurers, a few large pioneer insurers, information system providers, BigTechs, etc.

As in any ecosystem, once the number of participants in that ecosystem exceeds a certain threshold, the network effect causes exponential growth.

- Execution is complex and requires a significant evolution of the operating model

While some of the required capacities are reminiscent of those already put in place by insurers operating white labels or integrating offers from external producers, effectively managing a vast ecosystem of partners requires industrializing the management of this relationship, the acquisition of these partners. the management of their remuneration.

This requires setting up an “API as a Product” type approach, API portals in “self-service” mode and animating the developer ecosystem with new professions such as “customer success managers” because success will ultimately come from the success of these partners. The tools for managing this relationship must also be redesigned. For example, the identification and authentication of these partners (KYC), management of service levels, support and systems for monitoring performance and compensation are often to be built in fully automated mode.

The success of the Platform and IaaS approaches hinges on the ability to deliver a frictionless experience for the end consumer. This requires an integration of the operational processes of the partners with those of the insurer, in particular those related to compensation and level 2 and 3 support for consumers.

In terms of compliance and risk management, the obligations of information and informed consent towards the end consumer and respect for his privacy must be carried out jointly between the third-party distributor and the producer. Responsibility delegation processes, the duty to audit and regulatory disclosure often need to be overhauled to reconcile compliance and efficiency in the context of a large ecosystem of partners.

On the information systems side, API management often requires a new system to effectively manage the lifecycle of these APIs: development, testing, deployment, security, performance, version change, etc. In the background, a paradigm shift is required for developers: standards are often imposed by BigTechs and they evolve very quickly. However, the adoption of these standards is a key success factor.

Moreover, the business systems of insurers are rarely built to effectively manage the “multi-tenant”, create and close insurers on demand, generate and recycle test environments for third parties, manage “triggers” and notifications. in real time, etc. It is therefore important to urbanize upstream the cohabitation of API / IaaS infrastructure with existing systems and shared components (architecture, infrastructure, systems, life cycle, process, strong authentication, security, etc.).

Another potential drag comes from the contracts the insurer has with its key suppliers. It may be required to revise them to allow the “resale” of some of their services or solutions to third parties via APIs.

Finally, the digital skills required are very specific, rare on the market and not readily available from suppliers, as they are generally more attracted to BigTechs. In addition, both the platform and IaaS approaches require hand-in-hand work between insurance businesses and technological businesses requiring more than simple mutual understanding. This dual knowledge of technology and business is possible, but requires time, as does developing the “open” reflexes necessary to build trust and collaborate effectively with the ecosystem of partners and fintechs.

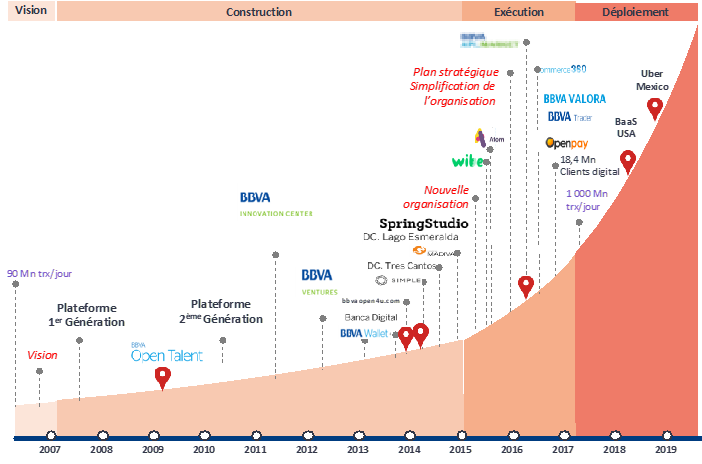

This adaptation of the operating model takes time. The BBVA group, for example, considers that it took almost 10 years, from 2007 to 2017, to build the foundations and implement the required operating model via a plan combining internal transformation and acquisition.

Since then, they have deployed their Platforms and BaaS strategies, depending on the market, with significant results on their results. They are now considered to be one of the leaders in Open Banking on a global scale, both for the scope of the offer and for their ability to collaborate effectively with a vast and diffuse ecosystem of partners.

- It’s time to get started… for a Marathon, not for a sprint

The example of Open Banking shows that a gradual approach is required to build all the required capacities and put in place the key success factors that will make it possible to take advantage of this opportunity, certainly emerging, but which will have as many impact on the insurance it has in banking.

If this has not already been done, insurers who will in turn want to take advantage of it tomorrow should therefore start today, without waiting for the regulator, with a sine qua non condition for being successful: making it a project of he company that mobilizes the entire executive, long-term on the agenda of the CEO and the Board of Directors.